Starting a new series on quick notes from the QIP Placement Document shared by the companies. We find this document to be more detailed in comparison to the Annual Report. The most detailed document is the DRHP but that comes out only for new listings.

This is not a Buy/Sell Recommendation. We may only post on companies we track.

All QIP documents generally updated on this link –https://www.bseindia.com/corporates/qip.aspx

LT Foods ( Daawat )

Company’s History

Company has 11 subsidiaries in India, nine subsidiaries outside India, two joint ventures, and three associates.

Products

We sell our products internationally under various key brands, including “Daawat”, “Royal”, “Devaaya” and “EcoLife”.

Introduced quick cooking brown rice, sauté sauces, ready to heat range of products.

Acquired brands such as “Gold Seal Indus Valley”, “Rozana” and “817 Elephant” in the past to gain presence in new geographies

Products can broadly be divided into the following six categories:

(i) basmati rice;

(ii) value added staples;

(iii) organic products;

(iv) regional rice;

(v) rice based snacks; and

(vi) other products.

In Fiscal 2017, basmati rice, value added staples, organic products and other products represented 77.36%, 1.60%, 7.24% and 5.31% of our total revenue from operations, respectively.

The following table sets out certain information on our product categories and certain of our key brands:

The sale of our premium segment products has grown significantly over the years. In Fiscal 2015, 2016 and 2017, sales of premium segment basmati rice represented 10.19%, 9.47% and 9.78%, respectively, of total sales of rice in such periods

In Fiscal 2015, 2016 and 2017, revenue from our organic segment represented 6.34%%, 7.53% and 7.24%, respectively, of our total revenue for the respective periods.

About Basmati

‘Basmati’ can only be cultivated in India and Pakistan, which makes them the sole suppliers in the world. It is grown only once a year, in the kharif cropping cycle, sown in May-June and harvested in September-November. In India, the major Basmati rice-producing states are Punjab, Haryana and Uttar Pradesh, which together account for over 95% of the country’s total Basmati rice production

India’s Basmati rice production is estimated to be in the range of 5.8 million to 6.0 million tons, out of which around 4.0 million tons is exported, and the balance is consumed domestically

Basmati rice exports from Pakistan have declined steadily in recent years.

A majority of India’s Basmati rice is exported to the Middle East followed by the United States and United Kingdom. Demand from Iran, the second largest export destination for India, has been the most volatile. Iran’s rice consumption is estimated at around 3 million tons per annum, which is met through their domestic rice production of around 2 million tons per annum and the balance through imports.

The European Union (EU) is a key market for the industry, accounting for around 8% of the total Basmati rice exports from India. The following chart represents the trend of exports to the European Union over the past five Fiscal years

The following chart represents the key export markets for India’s Basmati rice industry:

A significant amount of time passes between when we purchase basmati paddy and sell finished basmati rice. During this period of ageing, the price of basmati rice may fluctuate. For example, in Fiscal 2015, 2016 and 2017, the average price of basmati rice we sold was ₹ 74,521 per MT, ₹ 59,891 per MT and ₹ 59,008 per MT, respectively. As such, if the price of basmati rice falls during the time it is held for ageing, we may not be able to recover our investment in the basmati paddy and processing operations, which could adversely affect our financial condition

Agro Exports – Share of Basmati and Non-Basmati

India’s total agro product exports was ₹ 520.69 billion in Fiscal 2017; however, almost 75% of the same was contributed by the sale of rice (both Basmati and non-Basmati)

Paddy Procurement

Basmati paddy prices declined in the procurement season of Fiscal 2015 and Fiscal 2016. However, Basmati paddy prices increased by 20% to 25% across varieties in the last procurement season (October – December 2016) on the back of relatively lower production

In Fiscal 2015, 2016 and 2017, we procured 450,739 MT, 398,288 MT and 356,663 MT, respectively, of basmati paddy.

How is Basmati Procured

Processing and Packaging Facilities

We operated five processing and packaging facilities in India. Aggregate rice milling and sorting capacity of 86.90 MT per hour, aggregate rice sorting and grading capacity of 72.00 MT per hour and aggregate rice packaging capacity of 86.30 MT per hour

Operated three packaging facilities in the United States, and a processing and packaging facility in Rotterdam, Europe

Storage Capacity

As of September 30, 2017, our aggregate storage capacity (including open and covered warehousing facilities) for paddy and rice was 637,900 MT.

Brand Ambassadors

Movie actor Amitabh Bachchan and Celebrity chef and Sanjeev Kapoor

Procurement Agents and Distributors

As of September 30, 2017, we had entered into arrangements with 210 procurement agents (who work for us on a commission basis, with commission rates of approximately of 1.00% of the sale price), across 200 mandis established by the various State governments

750 distributors across 29 States in India.

Export Revenues

In Fiscal 2017 and in the six months ended September 30, 2017, we derived 54.10% and 64.64% of our total income from outside India, respectively

In Fiscal 2015, 2016 and 2017, our income outside India was ₹ 12,827.34 million, ₹ 18,876.37 million and ₹ 17,972.85 million, respectively which accounted for 46.15%, 63.35% and 54.10%, respectively, of our total income in these periods

Top ten export customers accounted for 15.55%, 20.10% and 13.53% of our total income in Fiscal 2015, 2016 and 2017, respectively, while our largest export customer accounted for 6.35%, 9.15% and 3.27%, respectively

The following table sets forth our sales of products from the different markets in which we operate and as a percentage of total sales of products in the periods indicated:

Cost of Materials Consumed

Cost of materials consumed constitutes the largest component of our expenses and represented 78.55%, 75.46% and 77.55% of our total expenditure in Fiscal 2015, 2016 and 2017

Changes in prices 2016 vs 2017

The cost of rice consumed (including broken and unpolished rice) increased by 48.65%

Cost of paddy consumed also increased by 7.18%

Cost of packing materials also increased by 27.60%

The following table sets forth certain information relating to our cost of material consumed presented as a percentage of total income:

Product Innovation Centres

Two product innovation centers, one in Gurugram, India and one in California, United States, with a team of research personnel

Risks

Inability to timely procure sufficient good quality basmati paddy at reasonable costs

Failure on the part of such agents to procure, in a timely manner, the desired quality and quantity of basmati paddy

Fluctuations in the market price of basmati rice

Reduction in output due to pest attack and disease

Changing climate conditions and weather patterns

JV’s and Tieups

We have also entered into strategic joint ventures with Future Consumer Limited and Kameda Seika for the expansion of our product portfolio with a shareholding of 50.00% in our joint venture with Future Consumer Limited, and a shareholding of 51.00% in our joint venture with Kameda Seika.

Losses of Group Entities

Key Markets in 6MFY18

Competitors

There are five major organized players in the basmati rice industry in India, namely, KRBL Limited, LT Foods Limited, Kohinoor Foods Limited, Lakshmi Energy & Foods Limited and Chaman Lal Setia Exports Limited.

Realizations

Basmati rice export realizations are driven by two key factors – paddy prices (input cost) and international demand.

Fiscal 2017 witnessed the third consecutive year of decline in value of Basmati rice exports from India, despite the volumes holding firm, as realizations remained under pressure. However, there has been a rebound in the current fiscal with the first quarter witnessing 32% growth in exports – driven both by increase in realizations (25%) and increase in volumes (7%)

In the past, an increasing trend for these two factors pushed up average realizations from ₹ 48,448 per MT in Fiscal 2011 to ₹ 77,988 per MT in Fiscal 2014. However higher volatility in paddy prices has exerted continuous pressure on average realizations, which have declined further to ₹ 54,011 per MT in Fiscal 2017.

Branded vs Unbranded

The following table sets forth certain information relating to the quantities, amounts and percentage of our total branded and unbranded basmati rice sold for the periods indicated:

New EU Regulations pertaining to chemical residues in Basmati

Paddy Prices

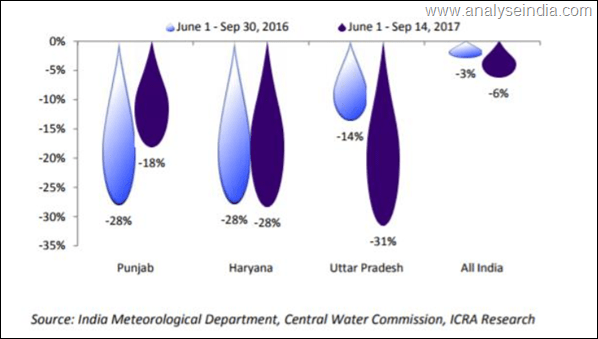

As per early estimates, paddy sowing in these states has decreased by 10% to 15% in the current fiscal, primarily due to lower rainfall received in these states as demonstrated below

Paddy prices are likely to remain firm in the upcoming procurement season, with an increase of up to 5%. While this should support the Basmati rice prices for the first two quarters of Fiscal 2018 and Fiscal 2019, it can adversely impact the profitability of operators in case demand declines, especially from international customers.

Storage

We typically store the basmati paddy in silos. As of September 30, 2017,

we had an aggregate storage capacity of approximately 637,900 MT for paddy and rice, including covered storage capacity of 371,020 MT and open storage capacity of 266,880 MT

Processing and Manufacturing Process

Intellectual Property

As of September 30, 2017, we had various trademarks registered under our Group across over 50 countries. We have over 80 registered trademarks in India, including “Daawat”, “Royal”, “EcoLife” and “Devaaya”. We have also filed applications for registration of certain other trademarks that are under various stages of review